Recently, we’ve seen an uptick in news surrounding Binary Options brokers and regulations, most recently with the reported layoffs from leading binary options brokers.

Trump and the China FX Market

The White House is looking at a new approach regarding China from keeping the yuan soft to help exports. The plan is to designate currency manipulation as an unfair subsidy when employed by any country. The National Trade Council is trying to formulate a way to challenge China without singling them out specifically. Read more

What Do Retail FX Brokers Want?

I was in Hong Kong recently for the iFX Expo. The expos in both Cyprus and Hong Kong have been a great meeting place for the retail FX community. The panel discussions are always informative but I find the most interesting conversations are outside of the venue. In the past, these conversations have centered on such topics as liquidity (tighter, deeper, cheaper…) and technology solutions, but at this event, the focus was on regulation. Read more

Regulatory Oversights – The Benefits Could be a Problem

The ever-changing retail Forex space has garnered a lot of attention in the past few weeks, headlined by FXCM’s eviction from the U.S. market. But they are not alone; the retail foreign exchange market has seen a steady decline in the number of US-based brokers, driven by the tight oversight of the NFA and CFTC. Read more

Being a Retail Forex Broker in a Trump World

If we look back at a daily chart over the past year, you will be able to quickly see the major political points that have highlighted 2016. The Brexit event in June created a 10% move in GBP/USD and a 4.5% move in EUR/USD, over a 24 hour period. Read more

To Trade or Not to Trade in December?

As Tripeak posts the Holiday trading hours for CFDs and FX, I think it’s important to bring up the question about trading FX, Metals, and Spot CFDs in December. Read more

Forex Trading Entrepreneurs

Diego Cortes, of Tripeak, was recently interviewed by Rankia, a financial news site. Topics include the different types of forex entrepreneurs, the trading businesses they are launching, the popularity of the FX market, and the keys to a successful forex startup.

Read more

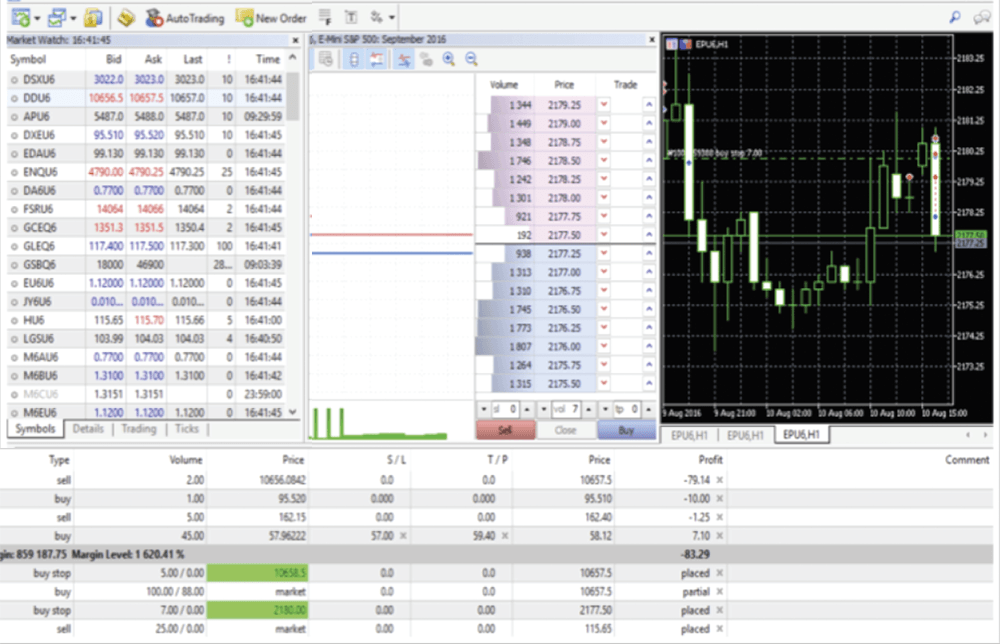

MT5 – CQG Gateway

An all-in-one platform for trading Forex, Futures and Equities.

Tripeak partners with CQG to provide access to the largest global exchanges.

3 Secrets of a Successful Forex Trader

3 Secrets of a Successful Forex Trader

Written by Fred Scala

I’ve been involved in the FX market for over 30 years. Most of the time as trader and risk manager for large US based money center banks. In that time I’ve learned some very valuable tips on what the most important qualities are to be a successful trader. I would like to highlight the three most important traits you need in order to have a long life as a successful trader.

Know Yourself

One of the most important lessons I learned was to know who I was and what my trading style was. It took me a while to figure that out. Was I a short term trader? Buying at 25 selling at 26, buying at 30 selling at 31… executing hundreds of trades per day each with a very small profit or loss? Or was I a medium term trader? Someone who would buy at 1.1400 and sell at 1.1600, sell 1.1500 and buy back at 1.1200… executing trades much less often but realizing much bigger gains and losses on each trade? Or was I a long term trader? Someone who would buy in January and sell in June? Some would say this is more of an investor rather than a trader but there are several big moves that occur over the course of time and people do position themselves for that.

A lot of retail traders don’t know who they are and what their style and tolerance should be. They may read an article about long term budget problems in the US and decide to sell the USD, that may be the right trade but their risk tolerance may not be in line. You can’t read a macro article and leave a 30 pip stop loss or stop profit on the trade; if you do you may be right or wrong for all of the wrong reasons. A macro trade may require you to keep the position on for 6 months or more, which would not coincide with many traders loss tolerance.

Be Disciplined

I’m sure you’ve read this in every trading book you’ve ever picked up. My definition of discipline is to determine your exit strategy before you enter the trade. As soon as you put a position on you should also enter your stop loss and stop profit orders. If you do that you will not be tempted to second guess yourself. I’ve seen too many traders enter a position, watch it move in their favor to their profit objective but never close the trade. The undisciplined will say ‘this can go further; I don’t want to take my profit now’. Once the trade does reverse they will be reluctant to close the trade until it goes back to the highs, that’s when profits turn into losses. I’ve also seen trades move to the stop loss point and the trader will say ‘I’m going to give this another 20 pips before I close it’ then they say it again and again and again. The old saying on the trading desk was ‘your first loss is your best loss’. Yes, sometimes waiting is the prudent decision but if you’ve done your homework and determined an exit strategy for both profits and losses you will be much better off in the long run.

Don’t Get Too High, Don’t Get too Low

I’ve seen many traders over the years convince themselves that they were the best on good days and the worst on bad days. It’s not sustainable to live a trader’s life like that. You have to understand that there will be good days and there will be bad days. The best hitters in Major League Baseball fail 70% of the time. The idea is not to be right; the idea is to make money. The trap that many people fall into is that they increase trading size and risk tolerance when they are on a hot streak, which would be fine as long as they decrease their risk tolerance once that hot streak ends, most people don’t.

If you can follow these simple steps you can enjoy a long and profitable relationship with the markets. If you can’t your relationship will be short lived and you will miss a great opportunity.

Please contact me to discuss trading and starting your own FX Brokerage Business.

Fred Scala

Fscala@Tripeak.com

Start Your Own Brokerage

The foreign exchange (FX) market now generates an impressive $5 trillion a day, making it the largest market (by volume) in the world. By combining our leading-edge technology and years of expertise in the FX industry, Tripeak can deliver the forex market directly to any entrepreneur interested in starting his or her own FX brokerage. If you’re looking to become a Forex broker, our Start Your Own Brokerage (SYOB) package is available at a variety of price points and capabilities and includes everything you’ll need to take advantage of the opportunities available in the foreign exchange market.

Tripeak Start Your Own Brokerage package is an ideal solution for those who want to take advantage of the growing Forex market.

Typical Clients Include:

● Investors

● Professional Traders

● Introducing Brokers

● Employees of existing Forex brokerages

● Banks looking to start their own FX operations

● Entrepreneurs looking to untap potential of the world’s biggest financial market

Get Started with Our Leading-Edge Technology and End-to-End Expertise

We offer a standard as well as a completely customizable integrated solution that includes everything a brokerage needs: trading technology (MT4 with real-time back office, servers, support, consulting and configuration), liquidity, legal (incorporation and bank accounts), operational compliance, 24/6 support and real-time monitoring and training.

//